|

|

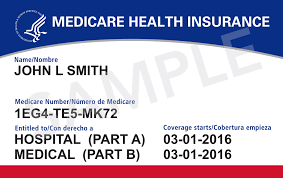

Whether you are approaching Medicare soon, or have been a beneficiary for a while, you’re probably noticing an increase in Medicare-related advertisements showing up in your mailbox. You’ve never felt more popular than any other time of your life, but at the same time, all this information may have you feeling a bit overwhelmed and confused! If that’s the case, I’m here to help! My goal with this blog post is to try to simplify the process as much as possible, so you can make an informed decision, get the right coverage, and get on with the rest of your life! Isn’t that what you really want? I’ll break it down into sections for you and include the most common questions I get asked almost every day! Stay with me for this quick 15-minute read and you’ll find additional resources to take advantage at the end that’s completely free! · “So what is Medicare anyway?” It’s health insurance for people ages 65 and up, as well as people younger than 65 with certain disabilities, and any age for people with End-Stage Renal Disease. (ESRD) ESRD is permanent kidney failure that requires kidney dialysis or a kidney transplant. · “What are the ABC’s of Medicare all about?” Well, it’s actually A, B, C, and D, and they represent the 4 parts of Medicare. Part A is hospital insurance and helps cover your hospital inpatient care, skilled nursing facility care, hospice care and home health care. Part B is medical insurance and helps cover the services that doctors and healthcare specialists provide. This includes outpatient care, home health care, durable medical equipment, certain drugs covered under Part B, and some preventative services. Let’s stop right here for a minute because to really simplify things, Part A and Part B were originally the only two parts to Medicare when it began in 1965. This is what they’re referring to when you hear or see the words “Original Medicare” or “Traditional Medicare.” · “Do I need to Enroll in Part B?” If you have coverage under your (or your spouse’s) current employer group health plan, delaying enrollment in Part B may be an option to consider. It really depends on how Medicare coordinates with your group health plan, whether it’s primary or secondary. It’s always a good idea to check with your employer or union benefits administrator to learn exactly how the group health plan coordinates with Medicare. It’s also important to understand that coverage based on employment doesn’t apply to retiree coverage, VA coverage, COBRA or individual ACA health plans. Enrolling in Part B when you become eligible would generally be to your advantage, in these situations. Active-duty service members and their families who have TRICARE should enroll in Part A and Part B when first eligible to stay enrolled in TRICARE. The same goes for CHAMPVA coverage. What is Not Covered Under Medicare Part A and Part B: · Long-Term Care (also known as custodial care) · Most Dental Work and Services · Eye examinations when it relates to prescribing glasses · Dentures · Cosmetic Surgery · Acupuncture · Hearing Aids (and exams for fitting devices) · Routine foot care That’s basically it for Part A and Part B of Medicare. Some folks stop right there and do nothing else. That means they are responsible for all deductibles, copays, and coinsurance. This also means they pay out-of-pocket for all their prescription drug costs, and most likely will pay a late enrollment penalty, if they didn’t enroll in a stand-alone Prescription Drug Plan (Part D) when they first became eligible. Keep in mind Original Medicare has no annual maximum out of pocket limits, which is why most people staying with Original Medicare choose to enroll in a Medicare Supplement plan, also known as Medigap. These plans are offered by private companies and are designed to cover some of the health care costs Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. Medicare Supplement Plans do not cover prescription drugs though, so if you want drug coverage, you’ll need to enroll in a stand-alone Prescription Drug Plan (PDP) Let’s move on to the next part of Medicare: Part C is also known as Medicare Advantage. This is an option to enroll in a Medicare plan offered by private insurance carriers approved by Medicare that includes all benefits and services covered under Part A and Part B. The difference is instead of Medicare paying your claims, the private insurance carrier now pays your claims. Instead of showing your doctor and other healthcare providers your official red, white, and blue Medicare health insurance card, you will show them your private insurance carrier card. Because of this, the Part A and Part B costs of Original Medicare we discussed above will be different because each private insurance carrier will break down the individual costs according to their Summary of Benefits and Evidence of Coverage booklets. To join a Medicare Advantage plan, you must be enrolled in Part A and Part B, and you must continue to pay your Part B premium. Some Medicare Advantage plans also include additional benefits like dental, vision, or hearing coverage typically not covered under Medicare, and most include Prescription Drug coverage. Types of Medicare Advantage Plans There are different types of Medicare Advantage plans to choose from, although not all types of plans are available in all areas. · Health Maintenance Organization (HMO) HMO plans require you to choose a primary care physician, see other health care providers, and visit hospitals that are all in the plan’s network. You may also need a referral from your doctor to see other healthcare providers. There are exceptions to going out of network such as emergency care, out of area urgent care or out of area dialysis. Some plans may allow you go out of network but typically at a higher cost. These plans are known as HMO’s that include a point of service (POS) option. · Preferred Provider Organization (PPO) PPO plans allow you to see any doctor or specialist but at a higher cost than if you choose health care providers that are in the plan’s network. In a PPO plan, you don’t need to choose a Primary Care Physician, though the plan may recommend it, and you typically don’t need a referral to see a specialist. Just remember, if you choose providers that are in the plan’s network, your costs generally will be lower. · Private-Fee-for-Service (PFFS) PFFS plans allow you see any doctor, other health care provider, or hospital that accepts the plan’s payment terms and agrees to treat you. It’s important to note that, unless your PFFS plan has a network, the decision to accept the plan’s payment term’s and agree to treat you depends on the provider. I recommend checking first with your doctors to make sure they accept the plan and agree to treat you if the plan does not have a network. If the PFFS plan does have a network, your costs generally will be lower by seeing doctors in the plan’s network. · Special Needs Plans (SNP’s) SNPs are limited to people with specific chronic diseases or characteristics such as being eligible for both Medicare and Medicaid. Typically you must see doctors, other specialists that are in-network except for emergency or urgent care needs, and out of area dialysis for people with End Stage Renal Disease. Generally, you need a referral from your doctor to see a specialist, except for some services like annual screenings. · Medicare Savings Account (MSA) MSA’s combine a high deductible insurance plan with a medical savings account used for health care costs. Once you’ve met your high deductible for the year, the plan will begin to cover your costs. The deductible can vary depending on the plan. The MSA plan receives a certain amount of money each year from Medicare for your health care. The MSA plan deposits some of that money into your account that can be used to pay your health care costs, even health care costs not covered by Medicare. However, only Medicare-covered Part A and Part B expenses count towards your plan’s deductible. If you use all the money in your account and need additional health care service, you will pay out of pocket until the deductible is met. Any money left in your account at the end of the year rolls over to the next year. Let’s move on to the fourth part of Medicare: Part D is a Prescription Drug Plan (PDP) offered by private insurance or other companies. Two ways to get drug coverage are either through your Medicare Advantage plan or by enrolling in a stand-alone Prescription Drug Plan. In either case, you must reside in the plan’s service area. I mentioned earlier that to join a Medicare Advantage, you need to be enrolled in both Part A and Part B. To join a stand-alone prescription drug plan, you can be enrolled in Part A and/or Part B. Why would someone be enrolled in Part B and not Part A? Well, if you’re not eligible for free Part A, you have the option to buy Part B, without having to buy Part A, as long as you are: · Age 65 or older · A U.S. resident and either a U.S. citizen, or an immigrant who is legally admitted for permanent residence, and has lived here without a break, for the 5 year period immediately before the month you apply for Part B. · “How do Part D Prescription Drug Plans Work?” Medicare drug plans have their own list of covered drugs called a formulary. Drug plans typically place covered drugs into different tiers, which each tier having different costs. A drug that’s in a lower tier will generally cost less than a drug in a higher tier. Your drug plan may allow you ask for an exception if your doctor thinks you need a drug that is on those higher tiers. Medicare drug plans can make changes to their formulary at any time throughout the year within guidelines set by Medicare. If the change affects a drug you are currently taking, your plan must either: 1. provide you a written notice at least 60 days prior to the effective date of the change, 2. or provide you with a written notice at the time of change and a 60 day supply of the drug under the same plan rules as before the change. Your drug cost can also vary depending on the pharmacy you use, and whether your plan considers it a preferred or standard cost sharing pharmacy. Some plans offer a mail-order option that may result in lower drug costs. Most drug plans have a monthly premium that varies among the plans and is paid in addition to the Part B premium. If you have a higher income, you may pay more for Part D. This is called the Part D Income-Related Monthly Adjustment Amount. (IRMAA) If you file individually and you earn above $85,000 or if you’re married, file jointly and make above $170,000, you’ll pay an extra amount in addition to your monthly premium. Most prescription drug plans include a yearly deductible, copayments, or co-insurance. Some have no annual deductibles, but for the plans that do, $415 is the maximum allowed for 2019. ($435 in 2020) · “What is the coverage gap?” The coverage gap, also known as the donut hole begins after the deductible if there is one, and the initial coverage limit. For 2019, once you and your plan have spent $3820 ($4,020 in 2020) for covered drugs, including the deductible, you’ve reached the initial coverage limit and are now in the coverage gap. While in the coverage gap you pay a maximum of 25% of the costs of the plan for covered brand-name and generic drugs until you reach the end of the coverage gap when your annual drug costs exceed $6350. Your yearly deductible, coinsurance, and copayments, as well as the discount you get on brand-name and generic drugs, and what you pay while in the coverage gap, all count towards getting out of the coverage gap. This is also known as your true out of pocket costs. Your monthly premium and any drugs you pay for that aren’t covered don’t count towards true out of pocket costs. Once you’re out of the coverage gap, you’ll get what’s called catastrophic coverage. This is where you pay a reduced coinsurance amount or copayment for covered drugs for the rest of the year. Keep in mind, because drugs costs can vary among the individual, not everyone will enter the coverage gap. Prescription drug plans typically have cost management rules in place such as: · Prior Authorization – Some drugs in a plan’s formulary may require you or a prescriber to contact them first to determine if the drug is medically necessary. · Quantity Limits – These are limits on how much medication you can get at a certain time. · Step Therapy – may require you to try a lower cost drug before they will pay for the prescribed drug. Prescription drug plans also offer additional management services for people who meet certain requirements, through the Medication Therapy Management (MTM) program. This service offers free additional help in managing your medications and using them safely, usually through discussions with a pharmacist or healthcare provider. Signing up for a Part D drug plan is optional but if you decide not to enroll when you become first eligible, in most cases you’ll pay a late enrollment penalty unless you had other credible coverage or you get Extra Help, also known as Low-Income Subsidy. This is a program available for beneficiaries that have limited income and helps lower the costs of prescription drugs. If your annual income and assets are below certain thresholds, you may qualify for Extra Help: Keep in mind you may still qualify even if you have a higher income in some situations such as if you still work, live in Alaska or Hawaii, or have dependents still living with you. What Medicare considers resources include money in your checking and savings accounts, stocks, bonds, mutual funds, and IRAs. Medicare does not count your home, car, household items, burial plot, up to $1500 for burial expenses (per person), or life insurance as resources. So in a nutshell, that’s the A, B, C’s, & D’s of Medicare. · “What are Medicare Supplement (Medigap) Plans?” Original Medicare has cost sharing that needs to be met, such as co-payments, coinsurance, and deductibles. Unlike Medicare Advantage plans there are no annual maximum limit thresholds with Original Medicare. Your part B coinsurance is 20% whether the bill is $1,000 or $1,000,000. Because of this Medicare Supplement (Medigap) policies were designed by private insurance companies to help reduce or eliminate some of the remaining Medicare approved healthcare costs. Medigap policies are standardized, which means every policy has to abide by federal and state laws designed to protect you. They must also be clearly identified as Medicare Supplement Insurance. A standardized policy is identified in most states by plan letters A through D, F through G, and K through N. The most popular plans include Plan F and Plan C, followed by Plan G and Plan N. *Plan F also has a high-deductible plan available in some states. If you choose this plan you must pay all Medicare-covered costs up until you reach the $2300 annual deductible in 2019, before the plan will pay anything. *Plan N will pay 100% of the Part B deductible, except for a copay of up to $20 for some office visits and up to a $50 co-payment for emergency room visits that don’t result in an inpatient admission. All policies must offer the same basic benefits based on the plan letter, but some may offer additional benefits. There are three states where Medigap policies are standardized a different way than the chart above: · Massachusetts · Minnesota · Wisconsin You must have both Part A and Part B to enroll in a Medicare Supplement plan. You will pay a Medicare Supplement premium, in addition to your monthly Part B premium. You may be able to buy a Medicare SELECT plan in some states. These plans limit your coverage to certain doctors and hospitals within their network. This helps to lower overall costs which typically results in lower premiums. · “When Should I Buy a Medicare Supplement Plan?” The best time to buy is during the Medigap Open Enrollment period. This is a 6 month period that begins on the first day of the month you turn 65 and are enrolled in Part B. This enrollment period gives you the protected right to enroll in a Medicare Supplement plan without any health underwriting. That means no health qualifying questions about pre-existing conditions, are asked. After this period, if you want to switch or enroll in a Medigap plan, you most likely will have to qualify for medical underwriting. There are certain qualifying events, however, that will give you a guaranteed issue right to enroll in or switch a Medigap policy. These events include: · Receiving a letter informing you that your health coverage is terminating, and notifying you of your right to enroll in a Medicare Supplement plan. · You have Original Medicare and a Medicare SELECT Policy and your moving out of the plans service area. · You joined a Medicare Advantage plan or PACE when you were first eligible and within the first year, you want to return to Original Medicare. · You dropped a Medicare Supplement policy to join a Medicare Advantage or Medicare SELECT plan for the first time, and within the first year, you want to switch back. · Your Medigap company becomes insolvent and you lose coverage, or your policy coverage otherwise ends through no fault of your own. · Leaving a Medicare Advantage plan or dropping a Medigap policy because you believe the company hasn’t followed the rules or it misled you. Some states have additional enrollment periods such as what is known as “the birthday rule”. This rule allows you to switch Medicare Supplement plans up to 30 days from the day of your birthday on a guaranteed issue basis. Some states, like Washington, have a special rule that lets beneficiaries with an existing Medigap policy to switch policies on a guaranteed issue basis anytime throughout the year. · “How Often Will My Medicare Supplement Rates increase?” Well, one thing I do know is Medicare Supplement rates can vary widely, and like everything else, rates do have a tendency to go up! How often is anyone’s guess, but you can generally anticipate the timing of an increase by the type of pricing method the policy uses. Medigap policies are typically priced or “rated” in three different classifications: · Attained-Age-Rated Policies · Issue-Age-Rated Policies · Community Rated Policies Attained-age policies are the type of pricing method most insurance carriers default to in many states. With this pricing method, the premium is based on your current age, (the age you have attained) so your rates increase each year as you get older. In addition to this once a year increase, premiums may also go up due to inflation or other factors. So you could see multiple rate increases within a year with this type of pricing method. Many carriers using the attained-age pricing method, however, have been able to maintain track records of modest single-digit rate increase history over the years. For attained-age policies, that’s the best you can hope for when it comes to rate increases. With Issue-age policies, the premium is based on the age you are when you enroll. (“issued” a policy) Premiums are lower for younger beneficiaries, and won’t increase as you get older, but premiums will go up based on inflation or other factors. Community Rated policies are unique in that the same premium is charged to everyone who has the Medicare Supplement policy regardless of age. Premiums stay the same as you age, but may go up based on inflation or other factors. In some states, like Washington for example, community rated policies are the only option you can buy. The community-rated premiums will vary among the carriers though so you’ll still want to do price comparisons. · Other Types of Medicare Health Plans Cost Plans Medicare Cost Plans are a type of Medicare health plan available only in certain parts of the country. It’s considered a “hybrid” in the sense that plan members can use in-network providers for their care or use providers outside of the network and be covered under Original Medicare. There are two types of Medicare Cost Plans: · Provides both Part A or Part B benefits · Provides only Part B benefits-usually sponsored by employer or union group plans. You can join anytime the plan is accepting new members. You can also leave anytime and return to Original Medicare. And you can get your drug coverage either from the plan or by enrolling in a stand-alone drug plan. (using one of the enrollment periods) Programs of All-inclusive Care for the Elderly (PACE) PACE is a Medicare and Medicaid program available in many states designed to help those needing a nursing home level of care remain in the community. To qualify for this program, you must: · Be 55 years of age or older · Be residing in an area served by a PACE organization. · Be certified by your state as needing a nursing home level of care. · Be able to safely live in the community with the help of PACE services, at the time you join. PACE covers a lot of services, such as prescription drugs, doctor or other healthcare professional visits, transportation, home care, hospital visits, and whenever necessary, even nursing home stays. You’ll be charged a monthly premium to cover the long-term care portion of the PACE benefit and a premium for Medicare Part D drugs, however no deductibles or copayments on approved drugs, service, or care. There’s no monthly premium for those on Medicaid. · “How do I apply for Medicare?” If you get Social Security or Railroad Retirement benefits, enrollment is automatic. Your Medicare card typically gets mailed 3 months before your 65th birthday. Your coverage starts the first month you turn 65 unless your birthday falls on the 1st of the month. In this case, your coverage will start the 1st day of the previous month. People under age 65 and have a disability automatically get Part A and Part B after they have been receiving Social Security or certain disability benefits from the Railroad Retirement benefit for 24 months. Medicare cards are typically mailed out on the 25th month of disability. People with Amyotrophic Lateral Sclerosis (ALS) also known as Lou Gehrig’s, also automatically get Part A and Part B the month disability benefits begin. All others need to apply for Medicare through Social Security (or Railroad Retirement) during your Initial Enrollment Period. This is a 7-month window that begins 3 months before your 65th birthday, the month of your 65th birthday, and ends 3 months after your 65th birthday. · Other Medicare Enrollment Periods If you didn’t sign up for Part A and or Part B when you first became eligible, and you’re not entitled to a special enrollment period, you can sign up during the General Election Period between January 1st and March 31st of each year. The coverage will begin July 1st. Remember there may be a late enrollment penalty for Part A, (if you’re required to pay a monthly premium), and a late enrollment penalty for Part B. Many seniors are working past age 65 these days, so in this case, you have the option to waive Part B, if you are covered under an employer group health plan. You will have a special enrollment period to sign up for Part B anytime as long as either you or a spouse, (or family member if you’re disabled) is working and have coverage under an employer or union group health plan. You will also have an 8 month special enrollment period to enroll in Part B, which begins the month after employment ends or the group health plan insurance based on employment ends, whichever happens first. Another enrollment period you’re probably familiar with is the one that happens every year beginning in October. This is the Annual Enrollment Period, also known as Open Enrollment, which begins December 15th, and ends December 7th of every year. This is the time you can join, switch or drop your Medicare Advantage plan or Prescription Drug Plan. Since plan benefits can change every year, this is the time you want to review your plans, especially the Annual Notice of Change booklet that gets sent out. to make sure you understand what changing, confirm that your doctor and other providers are still in the network and that your drugs are still covered in the plan’s formulary. During this time you want to make sure you understand what’s changing, confirm that your doctor and other providers are still in the network and that your drugs are still covered in the plan’s formulary. You want to make sure the plan you have today will be the right plan for next year. It’s also a good time to shop the competition and compare other plans. There’s also the Medicare Advantage Open Erollement period which lets you drop your Medicare Advantage plan and return to Original Medicare or change from one Medicare Advantage to a different Medicare Advantage plan, from January 1 through March 31 of every year. You can also pick a stand-alone prescription drug plan at this time if you are returning to Original Medicare. There are other special circumstances or events that may make you eligible to join, switch, or drop your Medicare Advantage or Prescription Drug Plan outside the other enrollment periods, such as: · When you move out of your plan’s service area · You are on Medicaid. · You qualify for Extra Help. · You live in an institution (like a nursing home) · You are losing creditable prescription drug coverage. There is also what’s called a 5-star Special Enrollment Period. Every year the Centers for Medicare & Medicaid Services publishes plan quality and performance ratings of Medicare Advantage, and Prescription Drug Plans. The overall star ratings vary among plans and can range from 5 stars which means excellent, to a 1 star which means poor. These plan star ratings are generally published every year at the beginning of the Annual Enrollment Period. The 5-star Special Enrollment Period allows you to switch to a Medicare Advantage, Medicare Cost Plan, or Prescription Drug Plan that has 5 stars for its overall rating. You can only use this Special Enrollment Period once from December 8 to November 30 of each year. · “What About Late Enrollment Penalties?” If you’re not eligible for premium-free Part A, and you don’t sign up for it when you become eligible, you may have a penalty of up to 10% of your monthly premium. If you don’t enroll in Part B when you first become eligible and weren’t eligible for a special enrollment period when enrolling, you could pay up to 10% of your monthly premium for each month for each full 12-month period that you could have had Part B, but didn’t sign up for it. For Part D, after your Initial Enrollment Period is over if you go 63 days or more without a Part D drug plan, or other creditable coverage, you’ll generally have a penalty to pay, unless you qualify for Extra Help. (Low-Income Subsidy) The Part D late enrollment penalty is currently calculated by multiplying 1% of the “national base beneficiary premium” ($33.19 in 2019) by the number of full uncovered months that you were eligible for but didn’t enroll a Medicare drug plan and didn’t have creditable prescription drug coverage. Creditable prescription drug coverage means you have coverage that’s expected to pay, on average, at least as much as a Medicare Prescription Drug Plan. In this case, you could keep that coverage without paying a penalty, if you enroll in Part D later. · How Medicare Coordinates with Other Coverage. If you have other health insurance or coverage and enroll in Medicare, coordination of benefits rules will apply in deciding who pays first. The primary payer pays first what it owes, then sends the rest to the secondary payer. There may even be a third payer in some cases. · Employer Group Health Plans Generally, If you’re enrolled in a group health plan from an employer with 20 or more employees, the group health plan generally pays first. If the employer has under 20 employees, Medicare generally pays first. Exceptions can apply though, so it’s always recommended to check with your employer to find out how the group health plan coordinates with Medicare. If you’re under age 65 and have a disability, Medicare generally pays first if your employer has fewer than 100 employees. When an employer has at least 100 employees, the large group health plan pays first. An important thing to keep in mind, if you go outside your employer’s network, it’s possible that neither the employer group health plan or Medicare will pay. So always check with your employer first before going out of network, to make sure you’re covered! · Medicaid Coordination Medicaid is considered a secondary payer after Medicare, or the employer group health plan pays first. · COBRA Continuation Coverage Medicare will pay first if you have Medicare either because you’re age 65 or older, or because you have a disability other than End Stage Renal Disease (ERSD). If you have ESRD, COBRA continuation coverage will pay first. When COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD, Medicare will pay second. · “Can I still contribute to my Health Savings Account?” (HSA) Once your Medicare coverage becomes effective, you can no longer contribute to your HSA. If you do, you’ll most likely have to pay a tax penalty. You can use the money that’s in your account to help pay for deductibles, premiums, copayments, or coinsurance though. So, in essence, you can draw from the funds, but you can’t add to the funds. One important tip to remember: You should stop contributing to your HSA at least 6 months before you apply for Medicare. Why? Because Part A coverage can be retroactive up to 6 months from the date you apply for Medicare (or Social Security/RRB Benefits), but no earlier than the first month you were eligible for Medicare. If you contributed to an HSA during any of those months that were backdated, you could be liable to pay tax penalties for those months that the contributions occurred. · Two Ways to Get Medicare Coverage After enrolling in Part A and Part B, you have two main paths to consider. 1. You can continue to stay enrolled in Orginal Medicare, and decide whether to add a Medigap/Medicare Supplement plan and a stand-alone prescription drug plan. 2. Or you can choose to enroll in a Medicare Advantage Plan, which most likely will combine drug coverage If your Medicare Advantage plan doesn’t include drug coverage, you may have the option to enroll in a stand-alone prescription drug plan. Keep in mind, if you join a Medicare Advantage plan, you can’t use or be sold a Medigap/Medicare Supplement policy, unless you plan to disenroll and go back to original Medicare. · “So Which Option Should I Go With?” It’s really is up to you! Some beneficiaries with Original Medicare have told me they like the freedom to see any doctor or specialist that accepts Medicare assignment anywhere in the U.S. That’s generally also the case when you enroll in a Medigap plan, except for SELECT plans, which limit hospital networks. With Medigap plans, you typically pay a higher upfront rate or premium, for the benefit of having minimal out of pocket Part A & B expenses to worry about. Some beneficiaries also have told me they like how their Medicare Advantage plan includes their prescription drug coverage. They were already used to managing networks when they had employer group coverage, so they are comfortable with that aspect of managed care. If Medicare Advantage plans are available in your area, you will generally enjoy lower or no upfront premiums, compared to Medicare Supplement plans, and will have cost-sharing up to the maximum annual out of pocket limit for the plan. These out of pocket caps can vary among the different plans but generally max out at $6700 per year. Need help deciding which way to go? Want to find out what plans are available in your neck of the woods? I provide complimentary phone/webinar consultations with no obligation to enroll in Nebraska, Texas, Utah, and Washington. And I have networked and built relationships with other reputable health insurance professionals nationwide! So whatever state you’re in, reach out to me through your preferred method of communication. Together, we’ll help you find the right plan! Sources: Two important sources I used for this article and learn from almost every day are: Medicare.gov – Everything you wanted to know about Medicare but was afraid to ask can be found here: https://www.medicare.gov/ The official Medicare & You 2020 handbook – I almost never leave home without it! If you haven’t received your copy in the mail yet you can get a digital copy here: https://www.medicare.gov//medicare-and-you/different-formats/m-and-y-different-formats.html Additional Resources: Every state provides free in-depth, one on one counseling and assistance to Medicare beneficiaries, their loved ones, and caregivers through State Health Insurance Programs. (SHIPs) You can find local volunteer help in your state by visiting The SHIP National Technical Assistance Center. https://www.shiptacenter.org/ Applying for Medicare is done through the Social Security Administration. Learn more about applying for Part A and Part B here: https://www.ssa.gov/medicare/ Learn more about the Extra Help/Low Income Subsidy program here: https://www.ssa.gov/medicare/prescriptionhelp/ Find out more about Medicaid eligibility for Seniors here: https://www.medicaid.gov/medicaid/eligibility/medicaid-enrollees/index.html *Disclaimer: ThomasAMatthews.com is privately owned and operated by Thomas A Matthews, an independent insurance broker, and has no affiliation with Medicare, Medicaid, or any U.S. government agency. The blog posts published here are for general informational purposes only, and should not be construed as a substitute for personalized professional advice. The purpose of this communication is for educational purposes as well as the marketing and solicitation of health insurance including Medicare plans. Please read my Privacy Policy for more information.

0 Comments

|

Contact Me(800) 769-0895 ArchivesCategories |

RSS Feed

RSS Feed